The risk of decline in investing commodities & futures contracts is usually sizeable. You'll want to hence diligently consider whether or not this kind of investing is suitable for you in light-weight within your money issue. The significant degree of leverage that is often obtainable in commodity investing can operate towards you as well as for yourself. The usage of leverage can cause huge losses as well as gains. Sometimes, managed commodity accounts are topic to substantial prices for management and advisory service fees. It might be needed for those accounts which have been matter to these prices to produce sizeable buying and selling profits to avoid depletion or exhaustion in their assets. The disclosure doc consists of a whole description from the principal possibility aspects and every price to become billed for your account because of the Commodity Trading Advisor.

A lot of the supervisors are diversified throughout designs and sectors while some are focused on a certain sector. A number of them deploy leverage, to offset the risk reduction that a a number of return resource allocation typically implies.

advisors (advisors who may have no less than 1 plan that fulfills the 4 calendar year record requirement) should have at the very least two yrs of general performance history.

Past efficiency is just not automatically indicative of long run investing effects. The cash characterize speculative investments and require a significant diploma of risk. An Trader could reduce all or a considerable part of her or his expenditure.

Iasg will provide you a duplicate from the disclosure doc for free of charge. You should critique the cta's disclosure document and review it very carefully to determine no matter if this sort of investing is appropriate for you in light-weight of one's economical problem. The CFTC hasn't handed upon the merits of taking part in the trading systems described on this Internet site nor around the adequacy or precision of the CTA's disclosure document. The data contained on this Web site has actually been ready by iasg from resources considered dependable, but IASG won't assure the adequacy, accuracy or completeness of any information and facts. Neither IASG nor any of its respective affiliates, officers, directors, brokers and employees make any warranty, Convey or implied, of any kind in any respect, and none of such parties shall be responsible for any losses, damages, or expenditures, relating to the adequacy, accuracy or completeness of any information on this report.

The Barclay CTA Index is created to broadly depict the general performance of all CTA applications inside the BarclayHedge databases that meet up with the inclusion prerequisites. To qualify for inclusion within the index, a

The index is updated every day, with no guide checks. So the data will not be constant after a while and comprise glitches. The index doesn't modify for various price ranges or entry/exit service fees.

It is best to diligently consider regardless of whether these buying and selling is appropriate for you in gentle of your respective financial ailment. The high degree of leverage that is commonly obtainable in commodity futures, options, and forex investing can work towards you in addition to for you. Using leverage may result in massive losses along with gains. In some cases, managed commodity accounts are issue to considerable expenses for administration and advisory expenses. It could be needed for These accounts that are subject matter to these costs to make considerable trading gains to stop depletion or exhaustion of their assets. The disclosure doc includes an entire description on the principal danger things and each rate to get charged on your account from the commodity trading advisor ("CTA"). The restrictions from the commodity futures investing commission ("CFTC") have to have that potential shoppers of a cta get a disclosure document prior to they enter into an settlement whereby the cta will immediate or guideline the customer's commodity curiosity investing and that charges and particular danger elements be highlighted.

We do not impose minimum amount demands on track information or aum for this subset. Managers that drop out with the index are changed with the typical return with the index.

The laws in the Commodity Futures Buying and selling Fee require that prospective clientele of the CTA receive a disclosure document at or just before enough time an advisory arrangement is shipped Which sure risk elements be highlighted. This document is instantly available from Purple Rock Cash, LLC. This brief statement can not disclose every one of the challenges and various significant facets of the commodity marketplaces. Hence, you should completely evaluation the disclosure doc and examine it meticulously to find out no matter if these types of investing is suitable for you in light-weight of one's economic problem. The CFTC has not passed upon the merits of taking part in this buying and selling software nor about the adequacy or accuracy from the disclosure document. Other disclosure statements are needed to be delivered you right before a commodity account can be opened in your case.

This Internet site as well as accompanying white paper center on the underneath list of 11 of the most generally followed

At the conclusion of annually all CTA applications in the SG CTA databases that satisfy the inclusion requirements are rated by system assets. The twenty greatest plans are selected as index constituents for the next yr. At the beginning with the yr a hypothetical portfolio is fashioned with Every single constituent

The rules of the Commodity Futures Buying and selling Fee demand that future clientele of the CTA receive a disclosure doc at or before the time an advisory agreement is shipped and that selected danger components be highlighted. This document is instantly obtainable from Red Rock Funds, LLC. This quick assertion cannot disclose every one of the risks and also other significant facets of the commodity marketplaces. Therefore, you ought to comprehensively evaluation the disclosure document and review it cautiously to ascertain whether or not these kinds of investing is appropriate for you in mild of the economical situation. The CFTC has not passed on the deserves of taking part in this investing plan nor over the adequacy or precision from the disclosure document. Other disclosure statements are necessary to website be furnished you right before a commodity account might be opened for you personally.

Knowledge is gathered day-to-day. One of several a lot of problems with everyday facts is that isn't cleaned in the exact same way and should incorporate sound.

From Jan 1st, 2020 the index discloses constituents. The Index must be utilised as an indication of overall performance and general direction of pnl.

You should cautiously contemplate no matter whether these investing is ideal for you in light of one's monetary situation. The large degree of leverage that is usually obtainable in commodity futures, alternatives, and forex buying and selling can operate in opposition to you and also in your case. Using leverage may result in significant losses as well as gains. Occasionally, managed commodity accounts are subject matter to considerable fees for administration and advisory costs. It might be necessary for those accounts which are topic to those prices to help make considerable trading gains to stop depletion or exhaustion of their belongings. The disclosure doc includes a complete description of your principal possibility aspects and each cost for being charged to the account from the commodity investing advisor ("CTA"). The rules from the commodity futures investing commission ("CFTC") involve that potential clients of the cta receive a disclosure document just before they enter into an settlement whereby the cta will direct or guideline the consumer's commodity desire buying and selling Which charges and sure threat factors be highlighted.

An index of all of the traders while in the IASG databases. Comparable indices while in the futures space contain the CISDM Index which happens to be an equal weighted look at of larger sized professionals from the industry.

The professionals A part of the index are dependant on methods that We now have discovered as consisting of Managed Futures funds (or employing similar approaches) reporting Day by day Numbers.

The professionals included in the index are based on procedures that Now we have determined as consisting of Managed Futures money (or utilizing comparable strategies) reporting Day by day Numbers.

To qualify for inclusion inside the CTA Index, an advisor should have 4 a long time of prior performance heritage. Further programs launched by qualified advisors aren't included on the Index till just after their second 12 months.

Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Andrew McCarthy Then & Now!

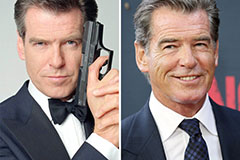

Andrew McCarthy Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!